PCM Software Technologies UK LTD is specialized in developing software for the financial industry with focus on products for brokers and financial companies that use Meta Trader 4.

We have developed a wide range of software products that work with MT4 server using its native API provided in the license granted by MetaQuotes Software Corp. to its clients.

All our software products are fully developed in-house and we haven't used any third party codes thus, our clients can request for any additional features and customizations and expect them to be ready and operational within a very reasonable time and budget.

Ongoing support and upgrades are available for reasonable standard fees.

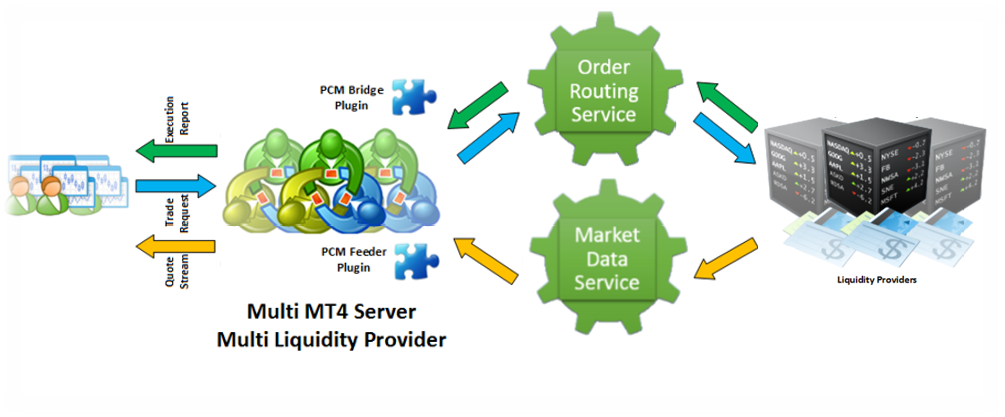

In this presentation we will focus on our multi-LP/multi-MT4 bridge and gateways solution that is capable of connecting several LPs/Markets (including futures markets) to several MT4 servers simultaneously. The solution is compatible with 2.2, 2.4 and 5.0 versions of the FIX protocol, FastFIX and generic and EMAPI feed protocols and customizable with any other protocols as per your requirements.

Our PCM MT4 bridge is also capable of handling pending orders received from MT4 client terminals in 2 different ways and even switch between these 2 methods of handling automatically depending on your requirements.

First have a look at the general architecture of the solution. It is worth to mention that the PCM feeder plugin for MT4 is capable of handling 2 way feeders such as EMAPI used in connection with the DGCX.

Overall system

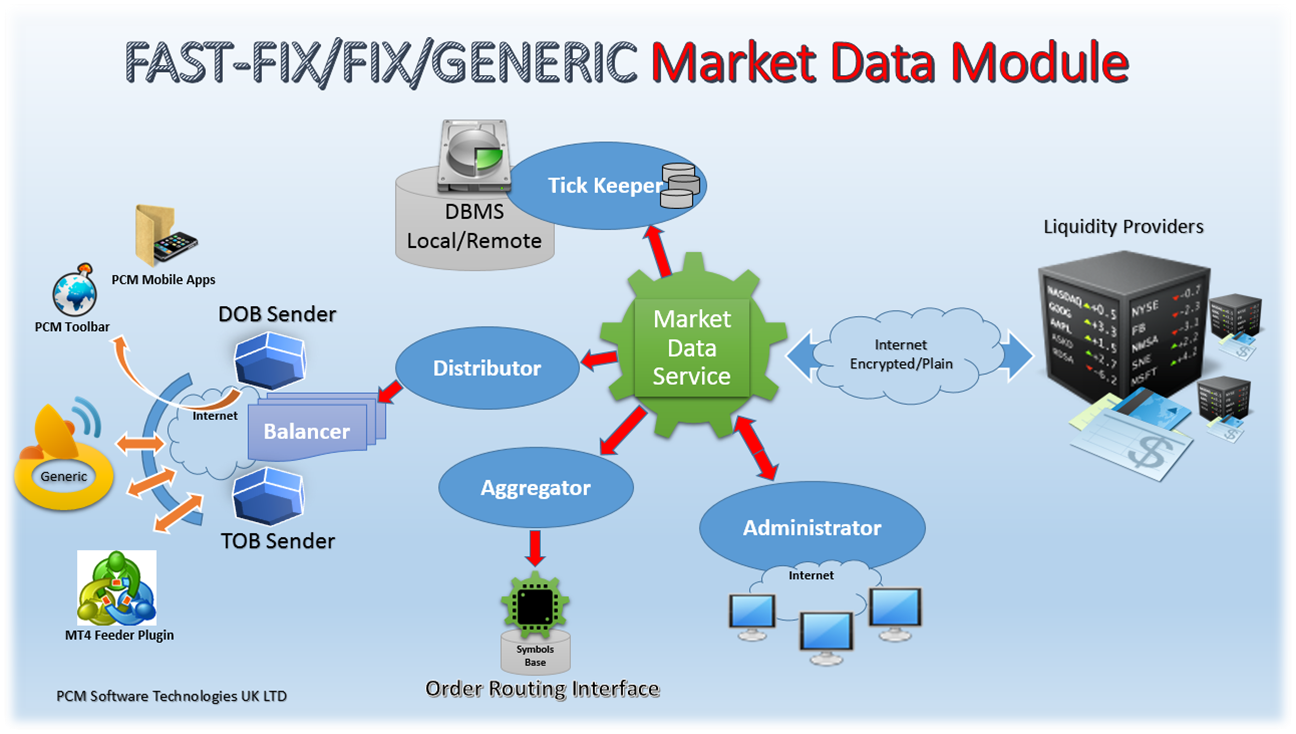

The market data service is displayed with more details in the following diagram.

It connects to several LPs/Markets simultaneously using customized gateways built for those specific sources on one side. It is optimized to use internet as means of communicating with markets/LPs and is equipped with an intelligent delay detector that checks the time stamps of the messages received and informs the PCM MT4 Bridge about such delays to be handled with regards to the clients terminals. It is customizable to work with leased lines as well.

The other side communicates with 4 destinations including Tick Keeper (saving and archiving market tick data), Aggregator (building your own market depth), Distributor (managing several destinations including MT4s) and a Remote Administration GUI.

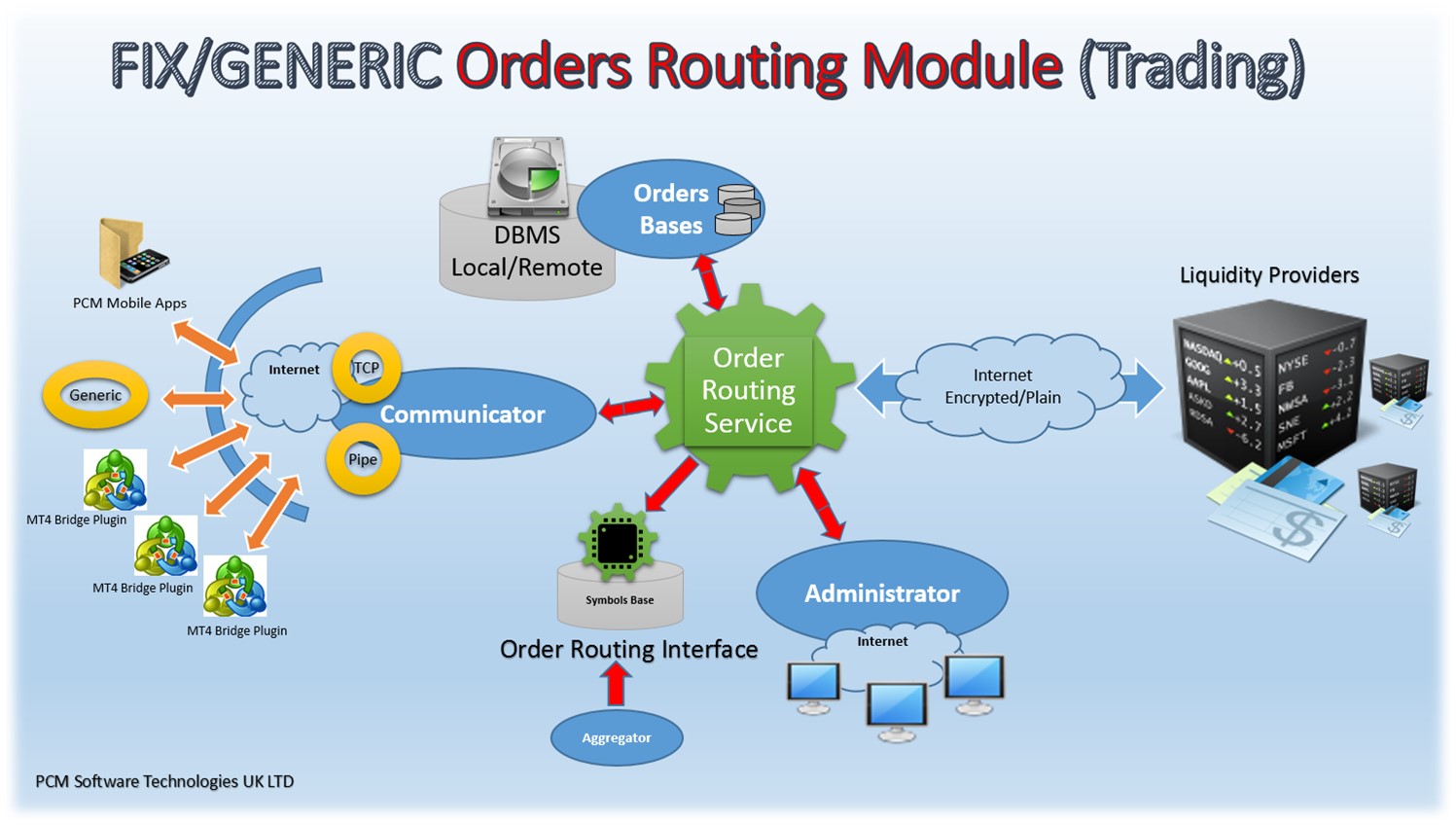

The Trading Engine has almost the same connection arms as the Market Data module and communicates with the LPs/Markets (including futures markets) via encrypted/plain messaging systems (FIX or any other protocol) over the internet and can work with leased lines as well.

On the other side and on top of the Admin, aggregator and archiving database connections, it communicates with a distributor that is capable of connecting mobile trading apps and several MT4 servers while keeping the trades done with their client terminals segregated.

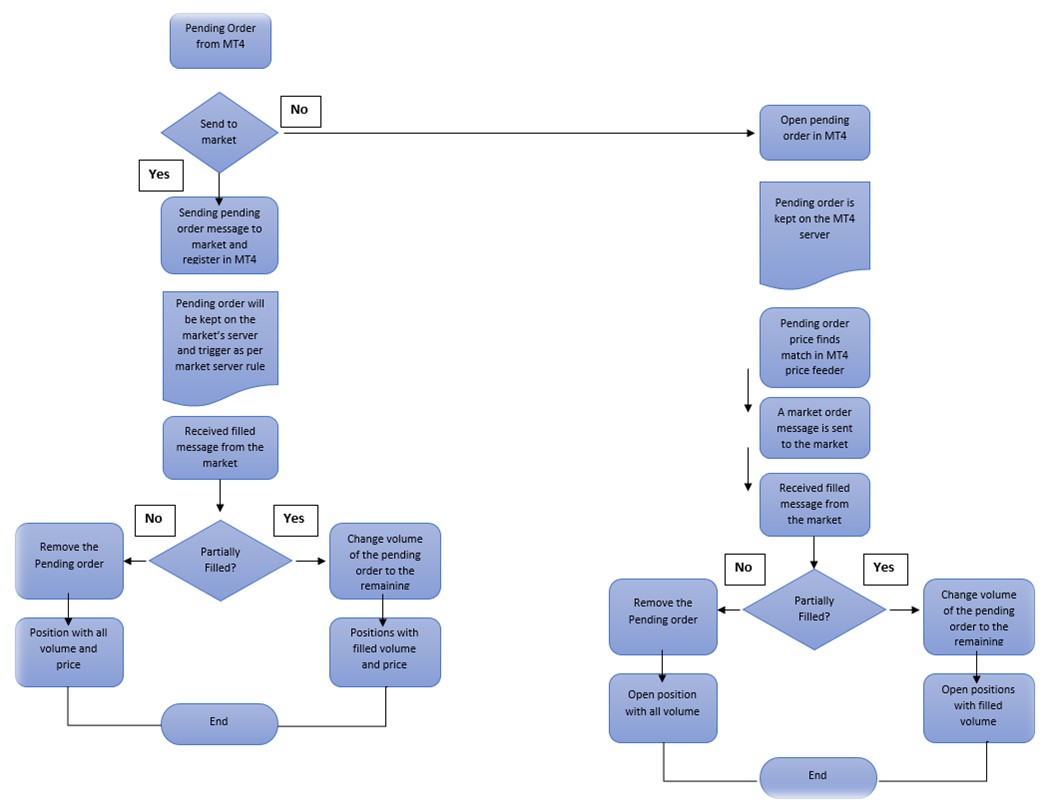

Handling of pending orders

Our MT4 bridge is capable of handling pending orders received from client terminals intelligently based on your requirements.

You may decide to keep such pending orders on your MT4 server and send them to the LP/Market as market orders when such pending order finds a matching price (Bid or Ask) in your MT4 feeder plugin,

OR

Send such pending orders to the LP/Market as pending orders and leave it to the LP/Market server to fill them.

Additionally you may instruct the bridge to switch between the above two scenarios in real-time depending on the instrument and the market where you wish that pending order to be sent to.

i.e. you may decide that pending orders sent to a specific LP/Market or a specific instrument (regardless of LP/Market) should follow first or second scenario.