Overview

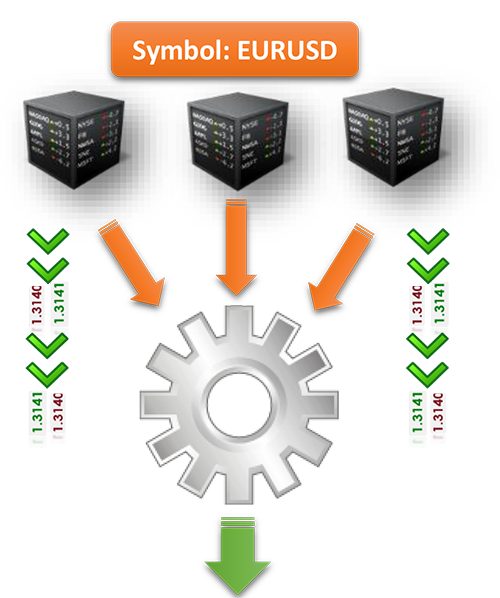

PCM Price Aggregator is the price feeding engine of all price aggregator based solutions. Allowing to aggregate several liquidities in one chosen table of instruments.

PCM Price Aggregator is not only a best price selector but also plays a major part in many other tasks related to price filtration, risk analysis, charting, publishing market depth and alternative order execution mechanisms.

Our price aggregator is designed intelligently to act in timely fashion way regardless of the best price selection techniques. In other words, it senses the market movement in terms of frequency and when the frequency of a particular symbol crosses its known (profiled) parameters the aggregator acts accordingly by lowering the priority of its source and looking for a new more trust worthy source of liquidity on that particular symbol or for the whole set of symbols of a liquidity provider.

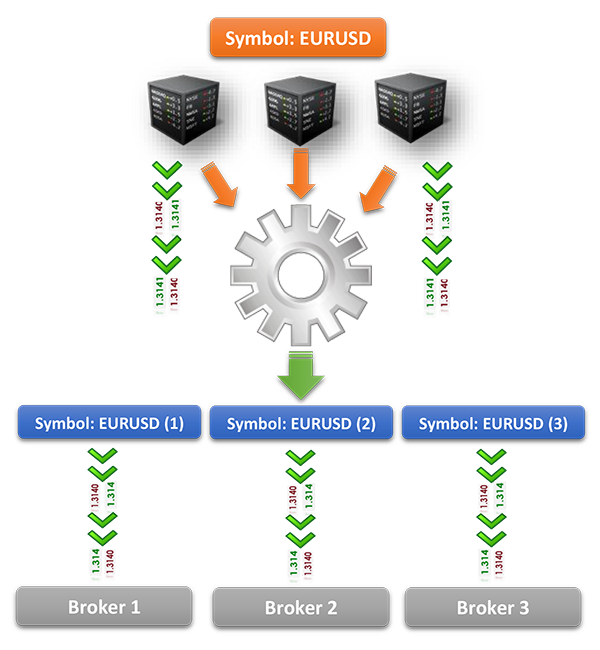

In normal cases you need the price aggregator to select for you the best price among several joined liquidities which is the case that we started but not ended our aggregator project on basically. Rather than a normal prices elector you may assign your own rules of electing best prices including time rules and quantity measures which is available only in PCM Price Aggregator. Moreover, you can select what to aggregate and how and what not to aggregate.

The features built in our aggregator are ones of their kind in the financial industry, giving the financial firm (broker) the ability to last look the price and control trading when the market is in unstable conditions avoiding the unwanted risk; exactly like what is happening in the matching engines of the worldwide forex exchanges.

|

Level |

Time |

Best LP |

Best Bid |

Quantity |

Best Ask |

Quantity |

Status |

|---|---|---|---|---|---|---|---|

|

1 |

T1 |

Lp_ID1 |

P1 |

Q1 |

P1 |

Q1 |

SCode |

|

2 |

T2 |

Lp_ID2 |

P2 |

Q2 |

P2 |

Q2 |

SCode |

|

3 |

T3 |

Lp_ID3 |

P3 |

Q3 |

P3 |

Q3 |

SCode |

|

N |

… |

… |

… |

… |

… |

… |

… |

Features

Multiple input-output sources-targets

Create more than one instrument each defines a different source/sources of liquidities.

Assigne different liquidities for different instruments or combine all in one.

Quote Time-out feature

Specify the time out for the instument regardless of the best price mechanisme.

Market Depth

Have your own market depth combined from multiple liquidities. With fixed spread (midpoint), floating and added spreads feature.

Costomize your own liquidity

After setting up your aggregator table you can publish your own custom liquidity based on your rules of spread and frequency.

Activate Multiple Level Trading

Alternate your orders rout by activating trading on multiple levels when the best price liquidy provider is off.

Benefits

- Multiple input/output instruments tabel.

- Aggregated Market Depth.

- Custom aggregation rules.

- Timeout based aggregation algorithms.

- Alternate orders rout through market depth.

- Offer tailored liquidity to other brokers.

- Customize the spread of the aggregated prices.

- Use the unique Fixed Spread feature for those who enjoy trading on fixed spreads.

- Controle the orders flow during extrem market conditions.

- Liquidate your liquidity using the price base generator.